Hello. This is Alex Bakker and Anay Nawathe with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Cloud Migration

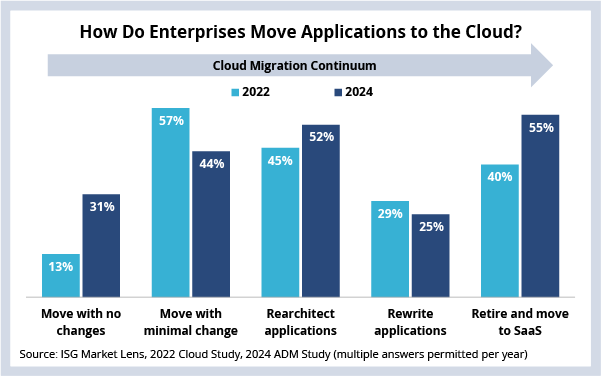

In our recent ISG Market Lens Study on Application Development and Maintenance (ADM), we wanted to compare how enterprises are migrating their applications to the cloud today to how they were doing so two years ago. We found that organizations are more likely now to retire legacy applications and migrate to SaaS or to engage in pure lift-and-shift migrations.

Background

When we last wrote about the cloud migration continuum in 2022, we observed that cloud migrations were a forcing function that was driving the growth of ADM contracts in the market. Many organizations at the time had signed minimum-spend contracts with hyperscale cloud providers and were in the midst of multi-year cloud migrations.

As a result of those contracts, we saw a propensity for “lift and shift” activity, which is to say migrating with no or minimal changes to applications. We also saw enterprises struggling to manage the expected challenges of scaling, resource allocation and security, since applications that were designed to run on-premises were not immediately portable to the cloud. The need to rearchitect applications to take advantage of cloud architecture was a critical component of realizing any cost savings from the cloud; a workload migrated to the cloud on a dedicated VM, for example, will not be cheaper than its on-premises counterpart.

Also at the time, a growing number of enterprises were selectively retiring legacy applications and replacing them with SaaS equivalents. In essence, this allowed them to shed the responsibilities of migrating, developing and maintaining applications and managing staff associated with the operation of those applications.

Now, two years later, we can see some interesting changes in the data. For one, there has been a shift from moving with minimal changes to applications to moving with no changes at all. This reflects the growing ability to containerize workloads to move them to the cloud truly “as is.” We also see a subtle change in companies’ likelihood to rearchitect applications, and this approach is continuing to drive work in the ADM sector. Finally, we have seen a substantial increase in the number of enterprises hoping to simply retire legacy applications and replace them with SaaS. Many companies who started their cloud journeys with “cloud first” strategies have evolved their strategies to “SaaS first” and “cloud right” to better leverage ISV and hyperscale provider services. This approach will hamper the ADM sector but likely presents an opportunity for systems integration work.

The Details

- As we spoke about on the last ISG Index call – ADM continues to drive growth in the IT and business services industry.

- Hyperscaler cloud growth has turned negative in 2023, facing headwinds from slow application migrations.

What's Next

The last two years have been hard on hyperscalers as major enterprises struggled to migrate to the cloud, realize savings or reach minimum spend commitments on their contracts. The data on enterprise cloud migrations here don’t suggest that the situation has improved, rather that organizations are losing patience with migration initiatives and choosing to skip them altogether.

The wildcard in the market will be generative AI. The combination of training and running AI applications has the potential to drive hyperscaler use and revolutionize the way companies rearchitect and migrate applications. This has the potential to drive reductions in migration costs or timelines, which may reinvigorate application migration initiatives. Additionally, the growth and maturity of AI-driven IT operations platforms (AIOps) have enabled organizations to better manage their workloads in the cloud through enhanced and simplified event correlation, automated remediation, root cause analysis and optimization recommendations. The reduced complexity of cloud operations will further reduce the barriers of entry to move and stay in the cloud. However, companies may go another route altogether, adopting SaaS to gain access to generative AI features that SaaS vendors have already developed, tested and released.

In the end, AI demand will funnel back to the hyperscalers that have the compute power to train and build foundation models, power the SaaS applications that will leverage AI and provide infrastructure for enterprise workloads. The magnitude of those three opportunities remains to be seen.