Hello. This is Michael Dornan and Alex Bakker with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Industry Demand

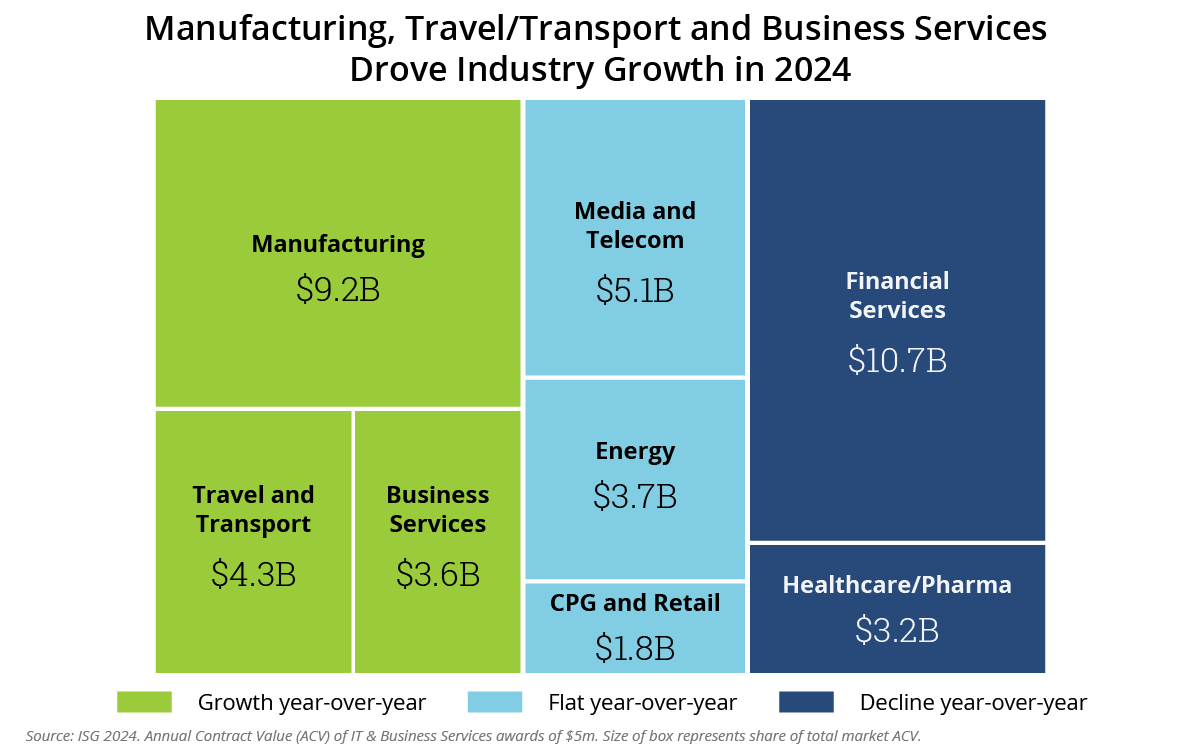

The Manufacturing, Business Services, Transportation and Hospitality verticals drove the lion’s share of IT and business services industry growth in 2024. In today’s Insider, we’ll take a look at the momentum for each of these industries – and a few more – to better understand what demand in 2025 could look like.

Data Watch

Background

The $41.7 billion of managed services annual contract value (ACV) generated in 2024 was a record for the IT and business services industry, but annual growth was down 1.6% from the previous year. Because the average contract duration grew to 2.9 years – from 2.5 years in 2023 – total contract value (TCV) for managed services also grew. This stemmed from the fact that significantly more deals had durations of three years or longer. The strength of the market varied significantly by industry. Manufacturing had another good year; Financial Services continued to be subdued.

The Details

- Manufacturing had a record $9.2 billion ACV in 2024; this was up 9% Y/Y. The number of awards was flat, but both contract duration and average ACV per award increased.

- Financial services ACV was down 6% Y/Y, the second consecutive year of decline. The number of awards was flat year over year, but ACV per award fell as BFSI mega-deal activity slumped.

- Healthcare encountered the sharpest fall in managed services award activity, down 33% Y/Y. Following five consecutive quarters of increased ACV from Q2 2022 to Q3 2023, new awards then fell for five consecutive quarters to Q4 2024, closer to the long-term average.

- Business Services increased 11% Y/Y. ITO ACV was flat; all of the growth was accounted for by engineering, research and development (ER&D).

- Travel and Transportation rebounded from a disappointing 2023 with longer, larger deals in both EMEA and the Americas.

- Telecom, Retail and Energy were largely flat Y/Y. All three of these industries saw an increase in the number of awards, but a decrease in ACV per award.

What’s Next

None of the industries that led growth in 2023 – Media & Telecom, Healthcare and Energy – maintained momentum in 2024. Growth in Media & Telecom and Energy was flat throughout 2024, while award activity in Healthcare declined.

Going into 2025, we are expecting that BFSI transaction activity will begin to recover. Already in Q424, BFSI bookings activity was up relative to Q2/Q324. If we look back at the five-year trend for BFSI, we see that the first year of the pandemic represented a significant acceleration of BFSI contract activity, with many of those contracts being renewed early and/or getting re-scoped to accommodate remote work.

Now, with return-to-office mandates increasing and BFSI deals hitting the ends of their terms, we expect activity will slowly return to normal. Macroeconomic headwinds will, of course, have an impact. If rates rise again to combat inflation, some of this activity may be deferred.

The other key area of focus will be Manufacturing. While bookings were slow in Q324, they picked up in the fourth quarter, outpacing ACV from the previous 12 quarters. Manufacturing ACV in 2024 was the highest it’s ever been. While the macroeconomic environment creates uncertainty in the market, cost optimization and AI adoption are two areas for which manufacturers are seeking support from the services industry.