If someone forwarded you this briefing, consider subscribing here.

2Q23 SUPPLY-SIDE CHECKPOINT

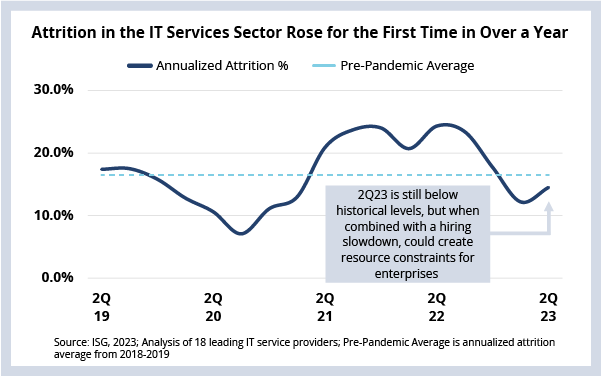

Attrition in the IT services sector rose in 2Q for the first time in over a year. This, combined with the industry-wide slowdown in hiring, means that enterprises can expect some challenges in finding in-demand skills for their engagements.

DATA WATCH

Hiring Down, Attrition (Back) Up

Over the course of 2021 and 2022, service providers added more than 2.2 million employees. This hiring explosion was in response to unprecedented demand for managed services in late 2021 and most of 2022.

However, the sector finds itself in a different place in Q2 2023. While managed services growth remains strong, providers have (on the whole) turned their focus to optimizing delivery pyramids to improve margins.

And they’re doing this by slowing down hiring. This approach has been working over the past couple of quarters, primarily because attrition has been declining from 2022 peaks.

Now a new set of supply-side challenges could be on the horizon. After three-quarters of quarter-over-quarter decline in annualized attrition (which represents the attrition in the quarter), attrition increased this quarter.

The Details

- Annualized attrition is at 14.5%, the first increase for the sector since 2Q22.

- Due to the industry-wide hiring slowdown, for every 10 people that left a provider in the second quarter, only six were hired.

Tight Market Could Get Even Tighter

It’s important to keep in mind that attrition is still well below the unprecedented highs of 2021 and 2022. And the slowdown in hiring is expected as well, especially given the pressure on discretionary work driven by macroeconomic uncertainty.

It’s the combination of these two factors that ISG clients should be aware of. Given that it will likely take a quarter or two for hiring to ramp back up – and if attrition continues to go up – it will mean there is very little “spare capacity” in the system.

Combine this with high utilization levels (which are now near all-time highs), and enterprises will likely face some challenges in finding in-demand skills for their engagements.