If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

CUSTOMER EXPERIENCE

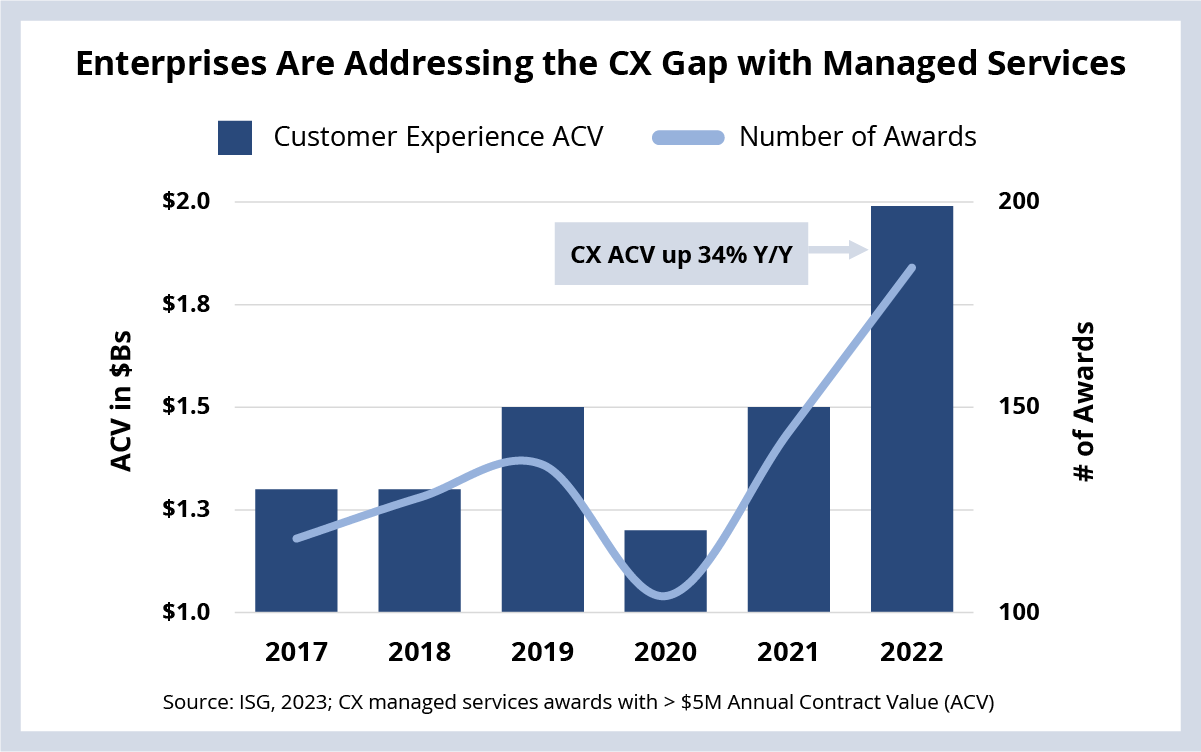

Customer experience (CX) is having a moment. Bookings for CX-related services are up significantly — and are being protected from enterprise cost optimization initiatives.

Background

As we discussed last year, the bottom fell out of the contact center sector during the pandemic. ACV for contact center was down almost 25% in 2020.

Then consumer demand returned in a big way - but with much higher customer expectations. Which means companies have to work overtime to win and retain customers, no matter what channel they are using.

And, as my colleague Kenn Walters says, “the quality of a customer’s experience often has its roots in their interaction with contact center workers.” And this is why contact center services are seeing such strong demand.

The Details

- Contact center generated over $2 billion ACV in 2022, up 34% year over year.

- The number of awards in 2022 was up almost 30% over last year.

- Europe led the way in 2022; ACV was up 40% over last year.

What's Next

CX transformation is becoming an essential area of focus for enterprises. It’s now a board-level priority. And this is one of the main reasons we see CX-related initiatives being protected from the huge wave of cost optimization happening across large enterprises.

However, in our latest buyer behavior research, we see enterprises in customer-centric industries like Retail, Banking and Healthcare experiencing a significant gap between the priority they place on CX performance and their actual performance. It’s a major problem when a top corporate strategic priority is falling short of internal expectations.

And this is a reason for the strong demand for CX-related managed services. Increasingly, traditional contact center and CX specialists are competing with IT services providers with solutions that use AI to handle routine customer requests, cloud technology to enable hybrid models (for clients or agents) and a gig workforce to address seasonal peaks and valleys.

We expect to see firms in customer-centric industries continue to aggressively invest in CX despite macroeconomic uncertainty. But just like in the consumer market, switching costs in the CX space are generally low, so we also expect to see enterprises aggressively evaluating their existing CX providers to address the gap.

I encourage you to join us at our 5th annual Xperience Summit in San Francisco on May 15-16. It’s a great opportunity to see how your peers are addressing the CX gap by humanizing the customer experience. My colleagues Sush Apshankar and Pratibha Salwan are co-hosting this awesome event – I hope you can join us.

DATA WATCH