If someone forwarded you this briefing, sign up here to get the Index Insider every Friday.

MERGERS & ACQUISITIONS

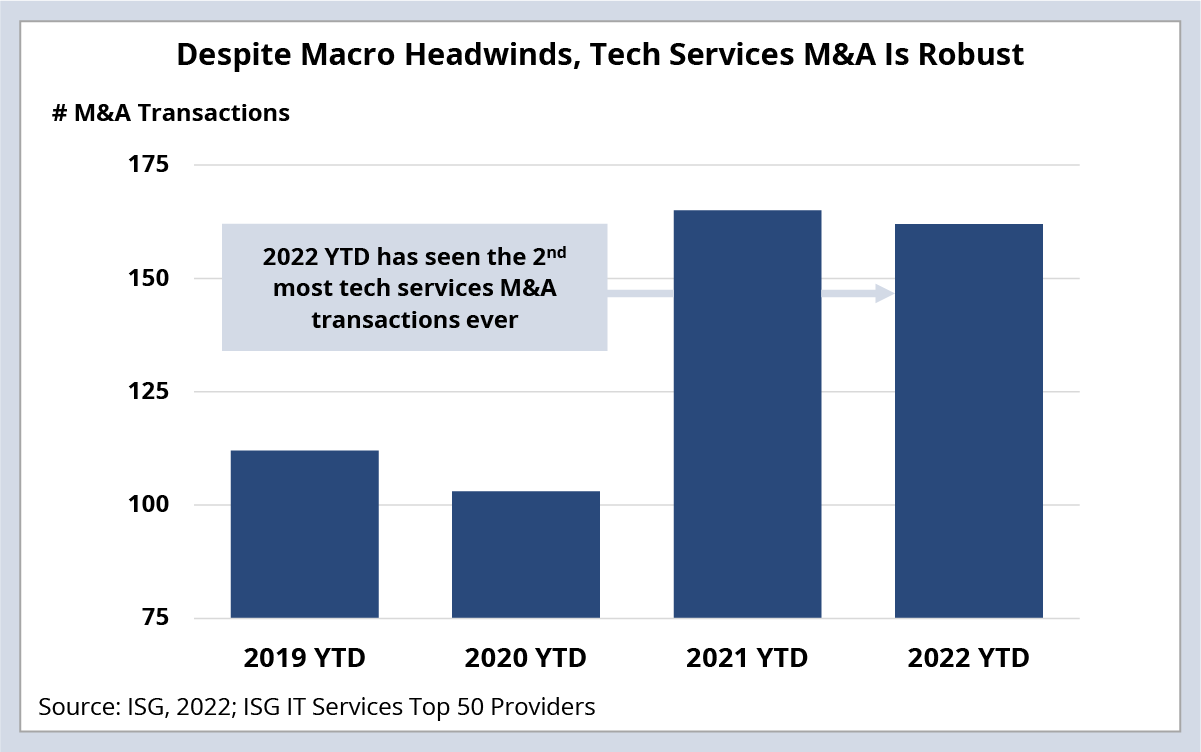

Despite the macroeconomic environment, the number of M&A transactions in the technology services sector is up significantly against historical averages. However, value is down over 50% YTD as firms focus on smaller, tuck-in acquisitions.

Background:

M&A in the IT and business services sector smashed nearly all records in 2021 as service providers, technology vendors and private equity firms aggressively sought out capabilities in cloud, engineering, analytics, user experience and cybersecurity.

Given the volatile macro situation in 2022, the prevailing opinion has been that M&A activity would significantly decrease for the year as a result. And, on value, it has. On activity, it hasn’t.

The Details:

- IT services firms have made 161 transactions YTD. That’s down 2% compared to 2021, but up over 40% compared to 2019.

- However, the value of these transactions is down over 50% from last year’s banner M&A year, as firms focus on smaller deals.

- For example, the number of acquisitions worth $50 million or less is up nearly 10% compared to 2021.

What’s Next:

That said, sizable deals are still being made – especially of late. For example, NTT Data acquired MuleSoft consulting firm Apisero (link), HCL acquired a majority stake in ed-tech platform GUVI (link), Accenture acquired manufacturing automation provider Eclipse Automation (link) and Sopra Steria is acquiring defense, security and energy specialist CS Group (link).

So, while macro factors are driving “strategic reprioritization” of enterprise technology budgets (as we discussed last week), we continue to see strong activity on the M&A front. And we think we're going to see an increasingly active M&A market through the remainder of the year and into 2023.

One of the key reasons for this is the fact that we are in a supply-constrained environment. Access to technology talent has been – and continues to be – exceptionally competitive. And labor markets remain strong.

This makes it tough for enterprises to find the talent they need when they need it, which we believe will continue to drive demand for IT services. And this, in turn, will drive acquisitions of businesses with this talent from service providers, consulting firms and private equity.

DATA WATCH