Enterprise IT organizations have some big plans for AI in 2025 that will play out in the midst of continued cost optimization and a tight labor market.

This is why we see two major themes emerging in 2025: 1) enterprises will deploy AI to improve productivity, and 2) they will fund it by optimizing costs elsewhere.

This will, of course, have a big impact on the IT and business services industry, which we’ll discuss in more detail next week.

Priority No. 1: Secure Funding for AI

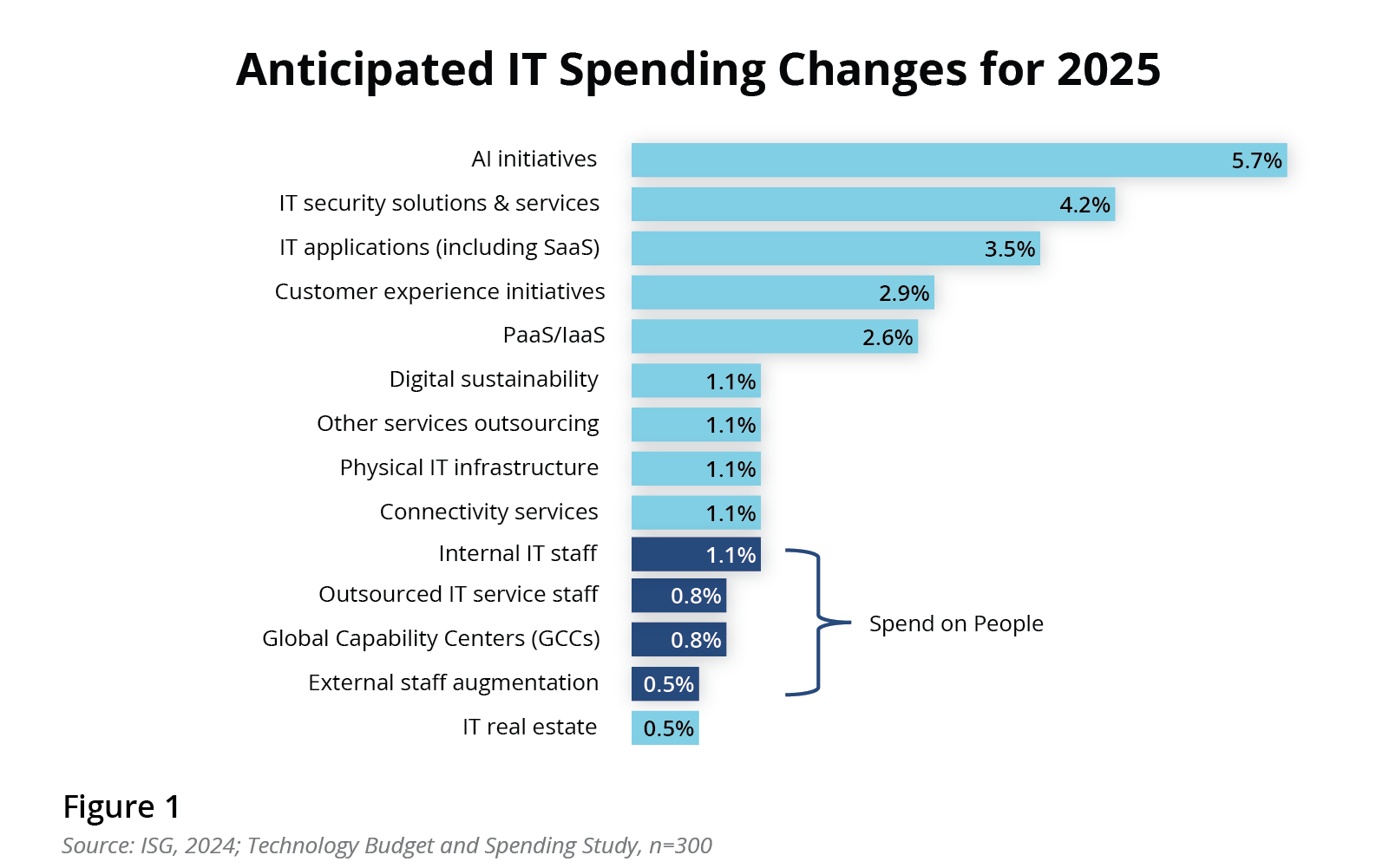

Enterprise spending on AI is projected to go up by 6% in 2025 (Figure 1), but the overall IT budget will go up by only 2%. This means IT organizations will be on the hunt for savings to fund their AI programs.

What will that look like? Honing in on optimizing network costs and software and cloud costs and shaving off expenses on contract terms and rates where possible. It also will include more sourcing.

Sourcing deals will include greater transformation, especially to improve efficiency and lower operating costs. And they will require year-over-year savings to be realized sooner than ever in exchange for longer-term agreements.

Priority No. 2: Increase Productivity

With most large enterprises expected to prioritize profits over aggressive growth in 2025, IT organizations will be laser-focused on getting more from the resources they have today.

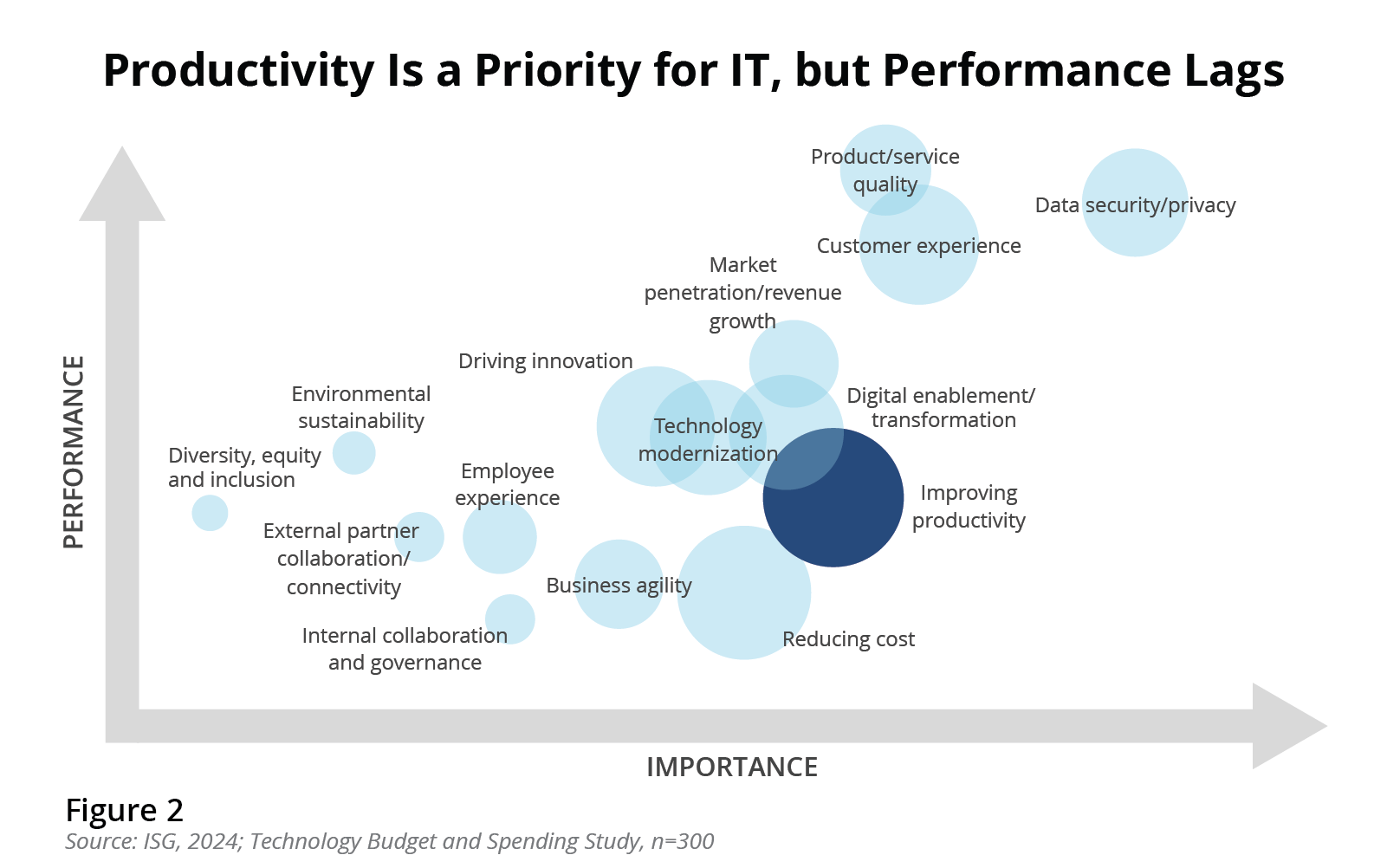

So far, most enterprises feel they are falling behind on their productivity targets and have not yet been able to realize the improvements they expected. Enterprises hope AI will be a game changer on this front in 2025 – and it’s one of the primary reasons we see such strong demand for productivity-focused AI use cases.

Priority No. 3: Find a Scalable, Cost-Effective Source of AI Expertise

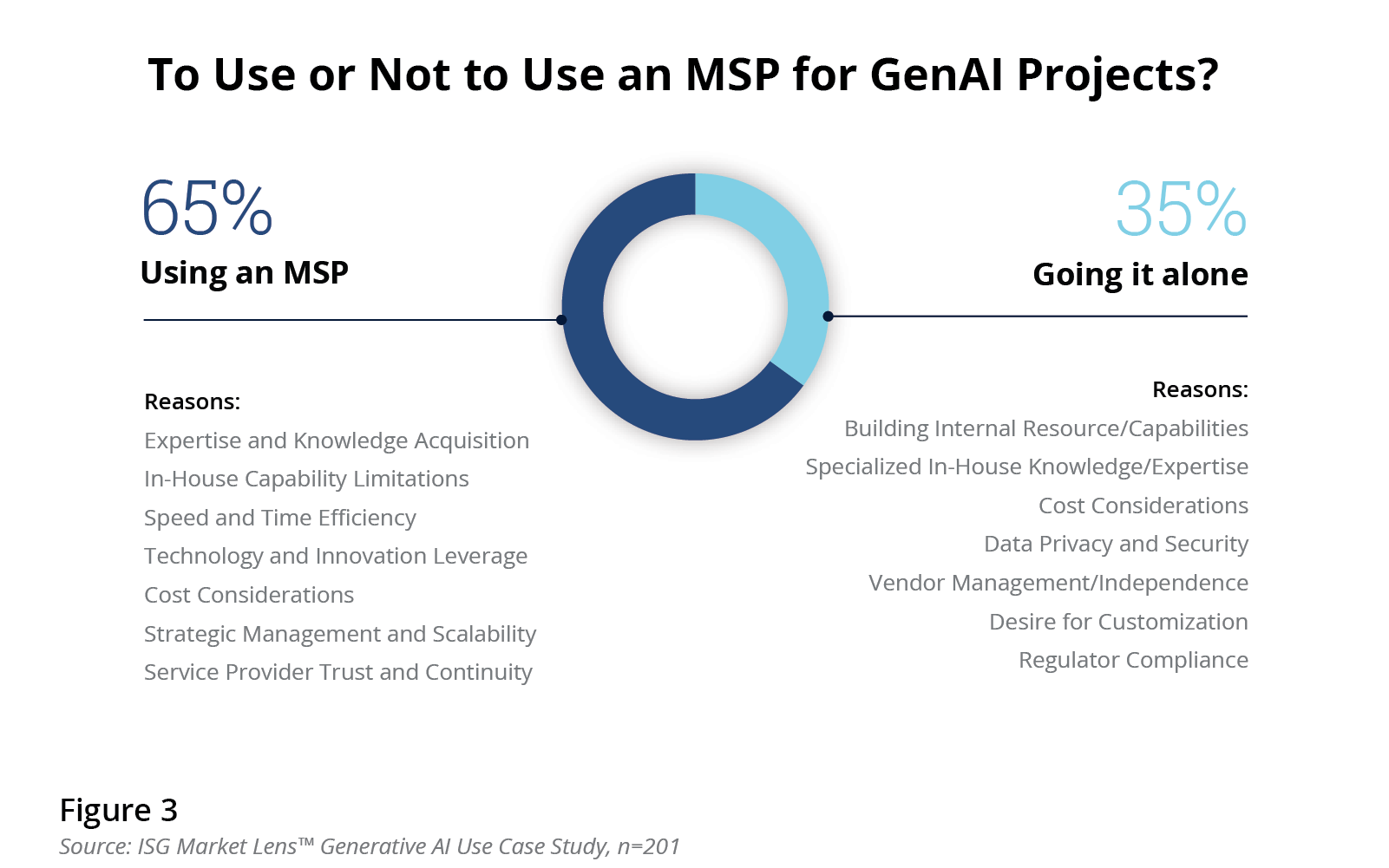

Most enterprises lack the internal capability to execute on their AI initiatives. This is leading to a search – often global in nature – to find that expertise.

Given that the shortage of AI skills is more of a supply problem than a demand one, enterprises increasingly rely on their provider ecosystems to source this expertise at a scale and cost that makes sense for them (Figure 3 below).

However, on the whole, providers in the IT services industry have been more successful delivering capacity than expertise. This means that, in 2025, enterprises will keep looking for AI expertise from their providers while also trying to build or strengthen their own expertise.

Priority No. 4: Align Delivery Models Based on Expertise, Cost and Risk

IT organizations use many different delivery models – in-house, staff augmentation, managed services, global capability centers – to find the expertise at the scale they need and at a cost that works for business.

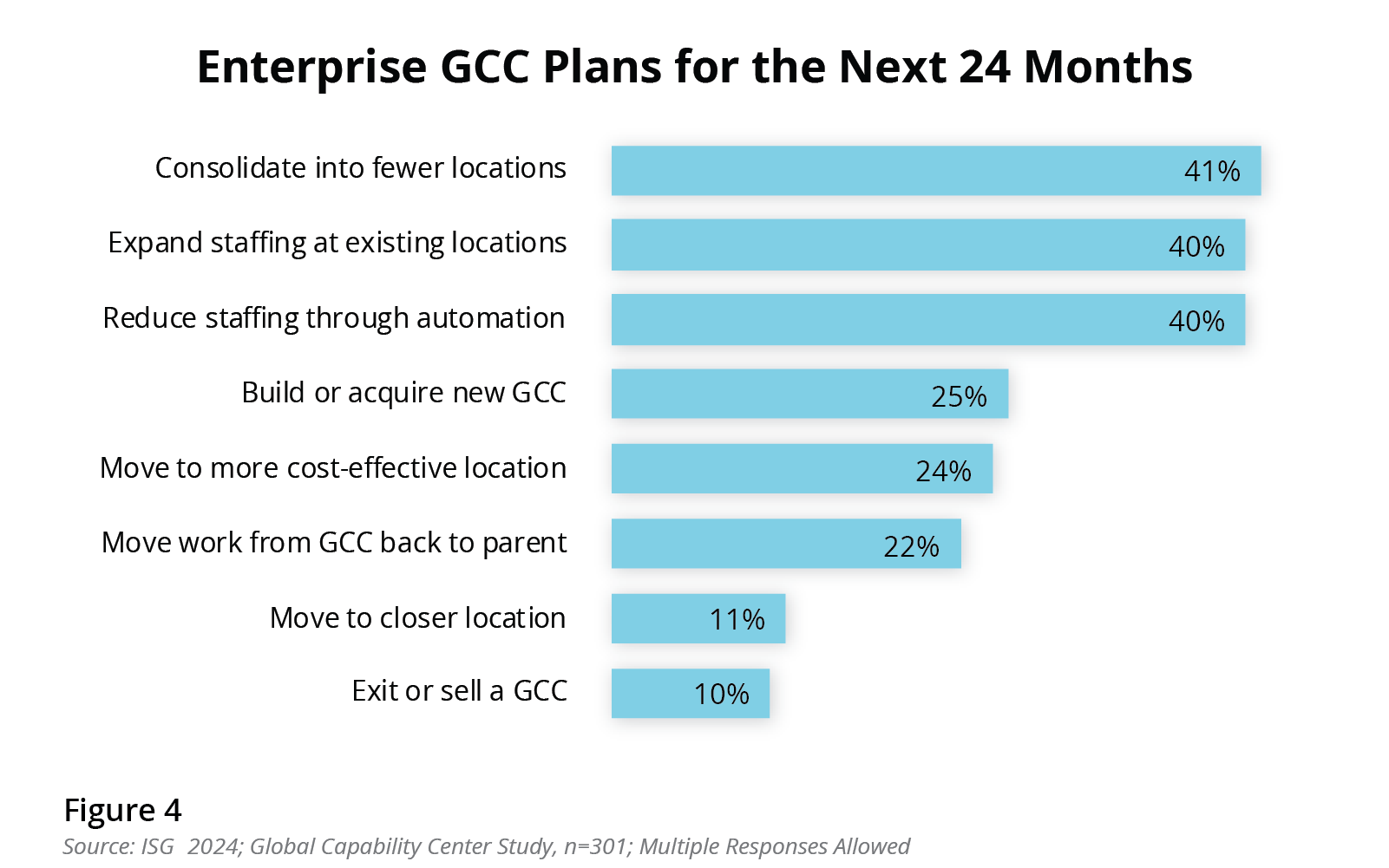

For example, enterprise GCC activity has been very strong of late. While we will see sustained interest in setting up and scaling GCCs in 2025, those that lack scale or specialization will likely face challenges related to cost and expertise (Figure 4). These enterprises will need to explore other delivery models.

Due to the rapidly shifting nature of AI use cases and technology, AI initiatives will likely lend themselves to project-based or staff augmentation delivery models.

We expect all these models will co-exist in 2025 with enterprises favoring the ones that quickly drive savings and/or expertise.

Priority No. 5: Decouple Data Management from Technology Management

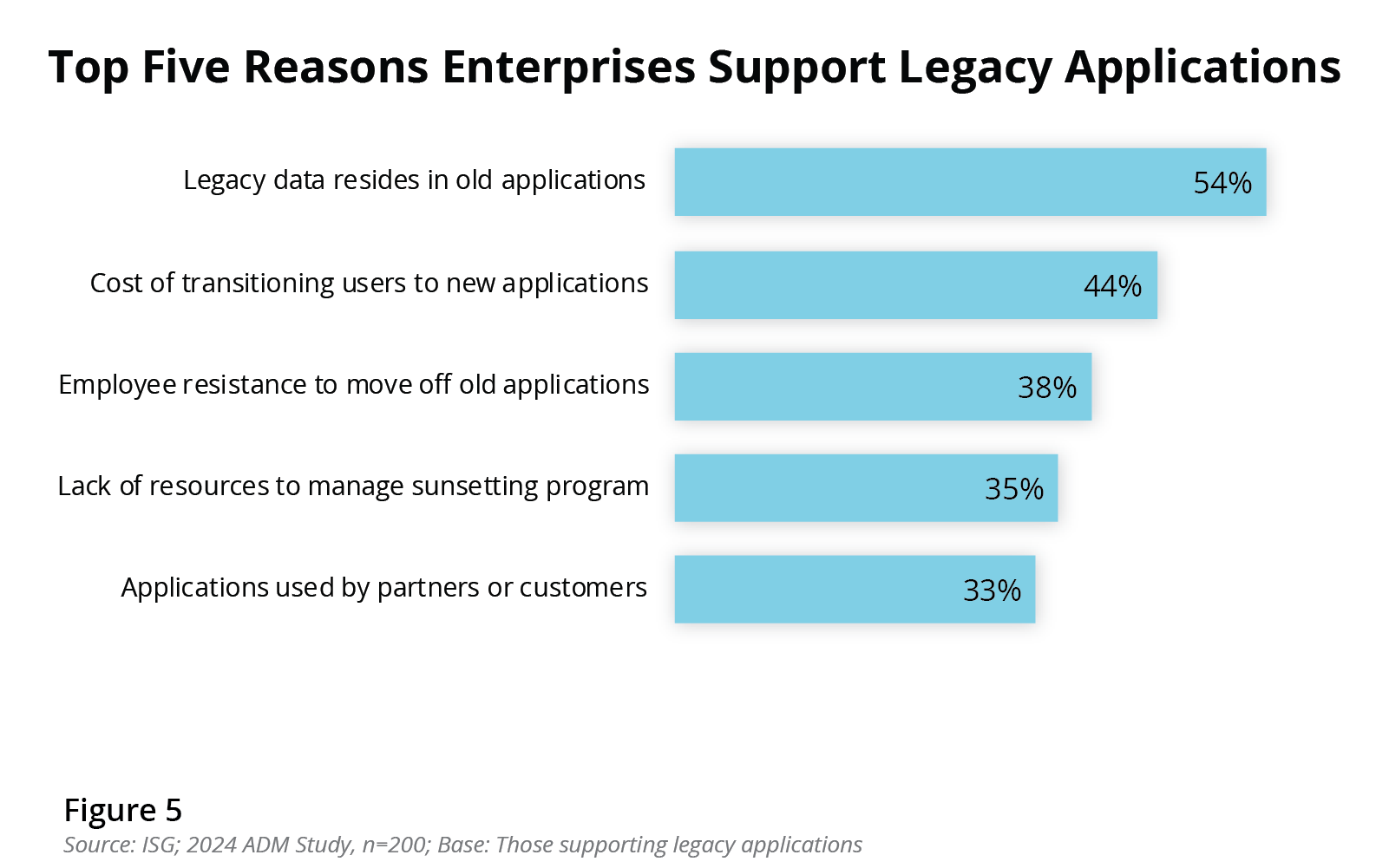

A tremendous amount of enterprise data is locked in legacy applications. It’s the number one reason enterprises keep these apps running. And firms need access to this data now to support their aggressive AI plans. We believe this will be the forcing function to decouple data from the underlying technology that supports it.

Enterprises will spend a lot of 2025 focused on data acquisition, engineering and governance independent of the underlying systems that store this data. A new set of data platforms and data services is already emerging to support this “data decoupling.”

This focus on data, driven by AI, will lead to the emergence of a new “data tower” independent of applications and infrastructure scope, for which enterprises will source.

Priority No. 6: Accelerate “Wave 2” GenAI Use Cases

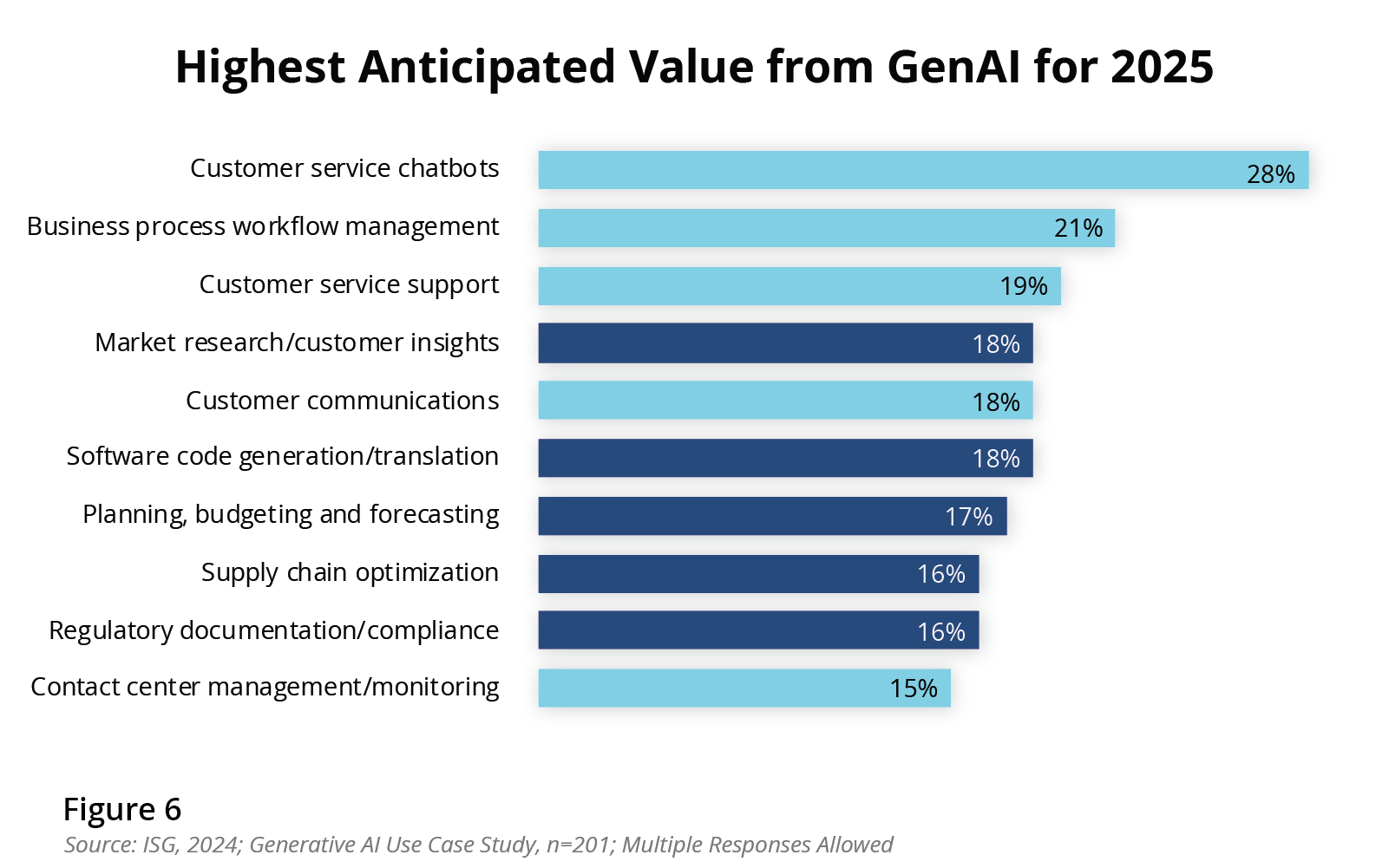

Wave one use cases include human-in-the-loop processes like contact center and customer experience, in which GenAI provides input in real-time to drive faster resolutions and more accurate solutions. In these cases, GenAI is still limited by the capacity of the contact center or customer service agent.

Wave two use cases will focus on augmenting expertise in areas like compliance, forecasting, market research and supply chain planning. So this next wave of use cases will be focused on scaling where expertise is the constraint rather than capacity.

Only 15% of GenAI use cases are in production today, as enterprises have not yet established a repeatable and reliable path from initial pilot to large-scale, production-ready workloads.

Priority No. 7: Reduce Complexity in Cloud

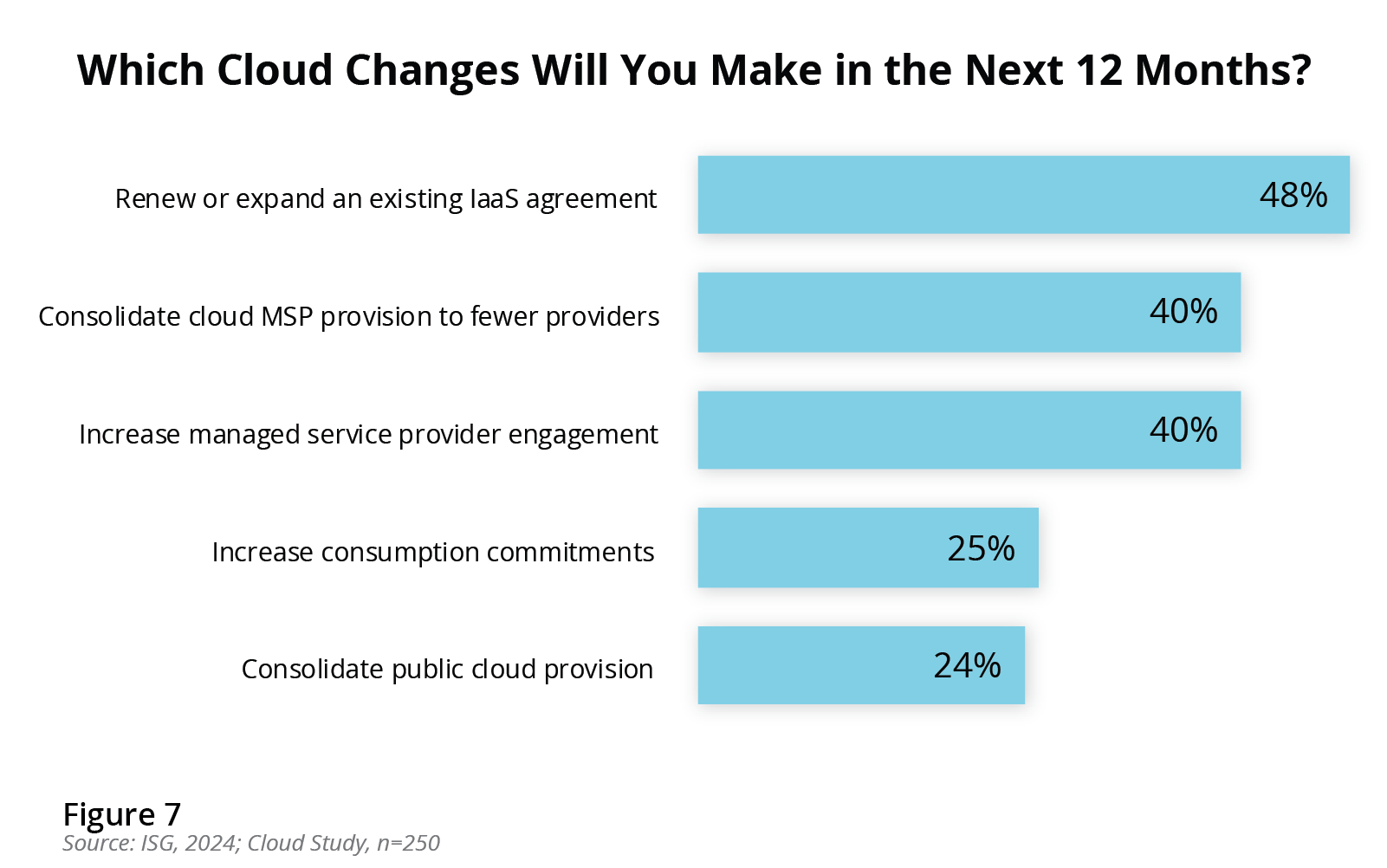

Enterprise cloud adoption has picked back up, primarily driven by interest in AI. But this comes after an 18-month period of enterprise cloud consolidation in which consumption went way down as firms optimized what they already owned.

In 2025, we’ll see a renewed focus on cloud management and governance to curb the massive cloud sprawl that occurred post-pandemic. Enterprises will lean heavily on their cloud managed services providers to execute on these plans, but they will use fewer MSPs to do it (Figure 7).

What’s Next

AI is a top priority for enterprise IT organizations in 2025. Deployment of use cases will be tempered primarily by an equal and opposite need for cost optimization and by a very tight AI labor market.

Enterprises will use AI to improve productivity and reduce costs. And, to do that, they’ll need to find funding. We believe funding will come from areas like technology modernization, consumption and license optimization, and strategic outsourcing.

This bodes well for the IT and business services industry, but it will put pressure on providers to find ways to accelerate savings and have the right skills and expertise, especially related to AI and data, when their clients come calling.