If someone forwarded you this briefing, consider subscribing here.

HIRING

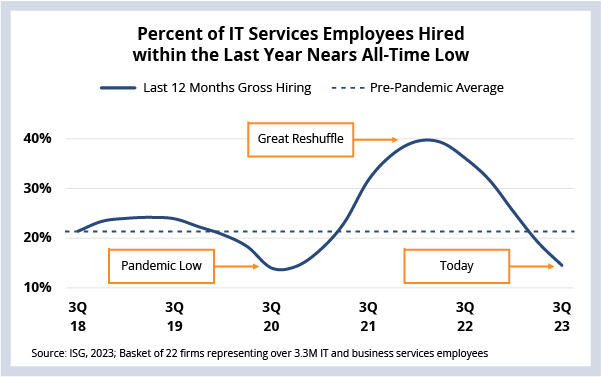

Service providers continue to delay hiring – especially at the entry levels – in response to softness in discretionary enterprise spending. Meanwhile, attrition remains stable. The result: the percentage of employees that started at their firm within the last 12 months is now at the same point it was during the lowest point of the pandemic. This is while managed services growth remains strong.

DATA WATCH

Background

Before the pandemic, many providers relied heavily on campus-based hiring to add entry-level capacity in anticipation of future demand. And during the post-pandemic boom, providers also turned to the subcontractor channel – and to competitors – to quickly add experienced lateral hires.

When these two hiring engines came together in the middle of 2022, it resulted in something that had never happened in the industry: 40% of the IT services workforce had been at their company for less than a year. This is what we called the Great Reshuffle.

But that changed in a big way this year. With the macro-driven pullback in discretionary spending, IT services growth has softened. At the same time, attrition has remained relatively stable for most providers, below post-pandemic highs and comparable to pre-pandemic levels. The industry responded by significantly slowing hiring across all levels of the workforce.

This has resulted in a complete reversal of the Great Reshuffle. Today, 14% of the IT services workforce was hired within the last year (see Data Watch). That’s as low as the lows of the pandemic quarters of 2020.

The Details

- Last-twelve-month gross hiring additions is 14%, down from a peak of 40% in 1Q22 and significantly below the 2017 - 2019 average of 21%.

- Annualized attrition is 14.3%, down from 14.6% in Q2, and below the 2017 - 2019 average of 15.9%.

What’s Next

As we discussed at our annual provider event earlier this year, the supply side of the IT services sector is undergoing a transformation. So much so that the pre-pandemic averages for supply-side parameters like attrition, hiring and utilization may no longer be indicators of a steady state for the industry.

And that’s because the industry is in a unique position: strong demand for cost optimization services is combining with soft demand for discretionary technology spending. That’s a new paradigm for the industry, and as you’ll hear from us on the Q4 Index call on January 18, we think this environment is going to continue well into 2024.

Providers demonstrated during the pandemic boom that they can rapidly scale up to meet demand. It was messy, but they did it. And, given the unpredictability of future demand, it’s feasible – maybe even likely – that some providers will re-think the hiring model that has worked for the industry for the last two decades and start to move more towards a “just-in-time” model.

Several providers have announced significant pullbacks in campus hiring this year. But it’s still too early to tell if this will be the start of an entirely new talent strategy for the industry, or a temporary response to demand uncertainty.

But what we do know is that it’s possible that the IT and business services industry will close out the year smaller – in terms of headcount – than it was in 2022. Even with ≈5% growth in contract value.