Summary and Recommendations

Salesforce cemented its position as a leader in enterprise software with its plans to acquire data visualization leader Tableau. This is a shrewd poke in the eye to competitors like Oracle, SAP, Google and Microsoft, and combines the might of a cloud software pioneer with the magic of the leading analytics reporting vendor. Tableau brings with it 80,000 customers and the opportunity to expand Salesforce’s market presence with any size enterprise.

Given the critical role customer analytics at scale play in digital business, this is an important acquisition that will allow Salesforce to capture market share from legacy (enterprise resource planning) ERP vendors.

Perspective

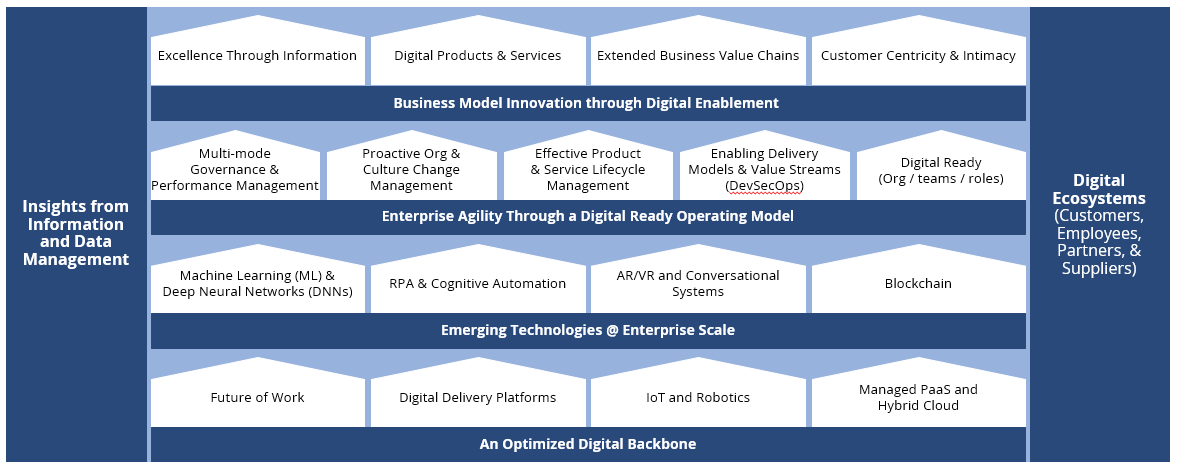

Salesforce plans to spend roughly $15.7 billion on Tableau in an all-stock deal, based on today’s valuation. It’s a high price but one that makes sense given the data visualization company’s market position, existing enterprise reach and potential for impact. Real-time visualization of data is the Holy Grail of decision-making in large enterprises and one of the core capabilities of digital transformation in any market (see the topmost level of ISG’s Digital Capability Model below).

Figure 1: ISG Digital Capability Model

Source: ISG

Salesforce plans to leave Tableau running as its own organization under current leadership. But Salesforce’s product teams will be pushing for Tableau integration to improve services like Customer 360, a multi-channel B2C engagement suite that pulls together data from several services for a single view of the customer.

Enterprises are likely to benefit from this acquisition, too, since Tableau will end up under the same roof as integration software maker Mulesoft, which Salesforce acquired last year. With these combined products, Salesforce will be able to provide enterprises a comprehensive look at their data across systems of record, and then visualize that information in Tableau.

This is the second major data visualization acquisition by a cloud titan in as many weeks. Last week, Google Cloud announced it would be boosting its analytics capabilities with the $2.6 billion purchase of software company Looker. These two deals show how critical data insights are to the future of digital business.

The obvious long-term synergy of both the technology and the combined company cultures will cause a significant shift in competitive dynamics in the enterprise and digital transformation markets. ISG expects Salesforce CEO Marc Benioff and Salesforce strategists to eventually extend the company’s existing Cloud Services and enterprise digital transformation platform with internet of things (IoT) data partnerships in various field service and supply-chain and logistics-intensive industries. This long-term move will subtly redefine ERP platform competition.

This acquisition may well serve as the pivot point for SAP and Oracle to accelerate business plans to compete as agile digital transformation platforms, perhaps divesting old on-premises ERP businesses and licensing models. Oracle and SAP cannot afford to maintain the legacy enterprise ERP business while native-cloud provider Salesforce adds compelling functionality at enterprise scale. Indeed, Salesforce may be redefining the term agility in the enterprise applications mega market.

Some major questions remain about the long-term success of this acquisition, however. Salesforce has a mixed track record with acquisitions, and it’s possible that the two teams may not be able to achieve expected synergies. Furthermore, how Salesforce will rationalize its existing analytics tools with Tableau’s capabilities and product roadmap is yet to be determined.

Finally, last week’s Looker deal raises another question: did Salesforce bet on the wrong horse? Tableau has been slow to take advantage of the cloud, and its capabilities are no longer light years ahead of everyone else on the market. While Tableau has continued to innovate and develop new products, startups and existing technology titans are nipping at its heels.

Guidance

While the boards of both companies have approved the transaction, shareholders and regulators still need to sign off on the deal, which Salesforce expects to close by the end of October. Maintaining Tableau as an independent business also means some time before the companies see significant synergy. At the moment, both companies will maintain separate account and support teams, and enterprises should reach out independently to each.

While marketing and pricing initiatives may appear in the next year, ISG advises clients to continue current Salesforce or Tableau implementation plans for at least 12 months, as we expect significant product integration and synergistic technology roadmaps will not be available for at least 18 months.