The excitement around blockchain and bitcoin was largely dismissed by the world as the crypto craze. And the word metaverse has started to weave itself into narratives thanks to Meta (formerly known as Facebook) and Microsoft. But under all the buzz, a larger story has been missed. A new avatar of the internet has been creeping up on the world. This new internet is the highly decentralized Web3.

Facebook’s renaming to Meta and public announcements from Microsoft’s Satya Nadella have thrust the word Metaverse into the general lexicon. Cryptocurrency exchange platform Coinbase has 68 million verified users. When the company recently announced a new NFT product, it attracted 2.4 million users to its waitlist.

As the digital and physical worlds increasingly meld with the growing acceptance of metaverse, crypto, NFTs and Web3, the business world has started exploring the market opportunities that this new internet brings.

To fully appreciate the value of Web3 and metaverse – and to chart a path to the opportunities they present, it is critical to understand how we got here.

The Era of READ

Web1 (from roughly 1990 to 2005) operated on open protocols that were decentralized and community-governed. Much of the value of Web1 was created and owned at the edges of the network — this was the time of users and builders. The rest of the world continuously read what the builders created and wrote. Some of us remember reading magazines online that still simulated the turning of pages. This decentralized the physical location of media.

The Era of WRITE

Web2 (from roughly 2005 to 2020) ushered in the creation of content en masse. Blogs led to posts, which led to social networks. These, in turn, led to established new platforms grabbed up by a handful of companies like Google, Amazon, Facebook and Apple. Most of the value here has been accrued by siloed, centralized services run by just five corporations (the above listed plus Microsoft). Anyone could create a blogpost, write an article, take a picture and influence the minds of millions. Content was decentralized, but at the mercy of five corporations.

The Era of OWN

We are now at the beginning of the Web3 era, which combines the decentralized, community-governed ethos of Web1 with the advanced, modern functionality of Web2. Web3 is the internet owned by the builders and users, orchestrated with tokens.

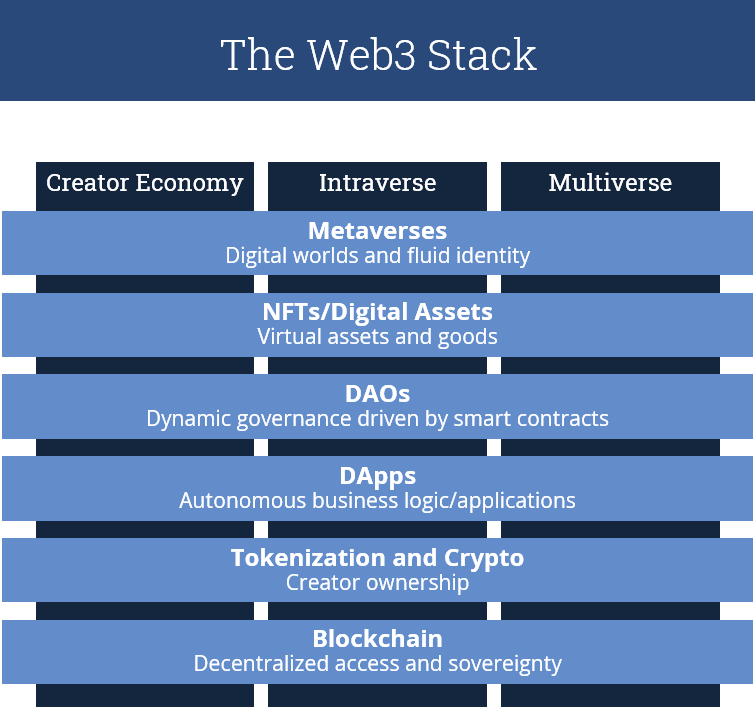

Delayering the World of Web3

Web3 is forming in front of our very eyes. A lot of attention is going into the individual layers of this internet – the metaverse, the NFTs, crypto. However, true value can be created only once one understands how the entire stack comes together – and when one appreciates new concepts, like decentralized, autonomous organizations (DAO), that have not yet entered mainstream language.

Metaverse

Unlike cyberspace, the metaverse will connect with reality by housing a large-scale virtual reality setting where anyone can have a persistent presence as an extension of their physical self or company. The technology needed to support and implement a truly immersive and ubiquitous metaverse is still years away. But firms have started creating virtual properties on metaverse platforms like Decentraland. Banks like JP Morgan have created their first virtual metaverse presences – this announcement brought JPM a lot of fanfare. System integrators like Deloitte and Accenture have just released their metaverse implementation offerings.

NFTs / Digital Assets / DApps

Tokens on the blockchain give users property rights. These can be anything from real estate to pieces of digital art. These are types of ownership in this new internet. Non-fungible tokens (NFTs) are one-of-a-kind tokens, the equivalent of the only Mona Lisa hanging in the Louvre. NFTs are digital assets that take the form of art, music, text, game objects, credentials, governance rights to virtual organizations, photos that can be linked to an event or special access passes. Digital assets and NFTs are the goods that are used and exchanged by actors within a metaverse. Decentralized applications (DApps) will offer services to physical and virtual worlds. MakerDAO is a popular DApp – a crypto-lending platform with its own digital currency called Dai. Users can borrow and lend using a decentralized application, with no middleman taking part of the proceeds.

Decentralized Autonomous Organizations (DAOs)

As owners across the world buy tokens, they realize they also are buying into an idea. That idea is either a protocol – a particular way a transaction could happen – or a social token – which gives them access to a community. A token allows for a capture of value and has evolved into a way of belonging to a decentralized autonomous organization, or DAO. Owning rare NFTs like Bored Ape Yacht Club means that you belong to a community that could decide to meet up for a yacht ride in the summer in NYC, a special invite-only event that you could participate in only if you own an NFT. This new community could decide to start a new DAO. Owning an NFT could give one voting rights in the DAO. And as the “market cap” of the DAOs rises, it will need governance just like any other financial institution.

DAOs are probably the most powerful layer of Web3 and the one least spoken about in mass media. This is where the focus of the Fortune 500 should be.

Crypto Token Economies and Decentralized Platforms

You can begin to see the links between the metaverse and blockchain now. Blockchain decentralized the ownership of assets and shattered physical boundaries. Anyone from anywhere can buy into a DAO, an NFT community, or just own tokens for financial or value exchange transactions. Such NFTs and tokens come to life on top of blockchains. These economies are important because they are the protocols of the future.

We are moving away from the world of apps (Web2) to a world of protocols (Web3). Functionality can be built in instants by joining the dots across multiple protocols. Business ideas can be brought to life instantly. The eyes of the Fortune 500 should be on the services and protocols, which will be the new PaaS services, emerging on Web3. It has never been easier to disrupt existing businesses by just joining the dots.

Blockchains: The Essential Substrate

Crypto token economies come to life and exist on top of blockchains like Ethereum. Ethereum is a decentralized global computer that is operated by its users. No one owns these computers, but anyone can access them.

Does Web3 and the Metaverse Matter?

Yes, it does. Centralized platforms like the big five tech companies we mentioned earlier have captured most of the value in Web2. The Fortune 500 have the chance now to create brand new experiences and goods to accrue value back to themselves. They will have the power to create and manage new communities (DAOs) to create loyalty and belonging. Will there be new platforms that will attempt to capture the new value just the way Amazon and Facebook has? Yes. Virtual world creators like Decentraland and Cryptovoxels show that there will be new players.

Web3 offers a new way that combines the best aspects of the previous eras. It’s very early in this movement – but it’s moving fast. Early uses will seem skeuomorphic, but as usage increases, there will be new native experiences.

The pioneers of today will be the leaders of tomorrow. ISG is helping enterprises understand, appreciate and strategize how they can prepare for Web3 and the metaverse. Contact us to talk about next steps.