Happy Friday, and welcome to the first edition of the ISG Index Insider!

Whether you are a service provider, technology vendor, enterprise technology leader, investment professional, a member of academia or the media, my team and I want to give you the most up-to-date data and analysis on the fast-moving global technology and business services markets – something you can read in five minutes or less.

If someone forwarded you this email, you can sign up here to get your own copy each week. And we want your feedback. Feel free to send me a note at [email protected].

Here's what's important this week.

MARKET

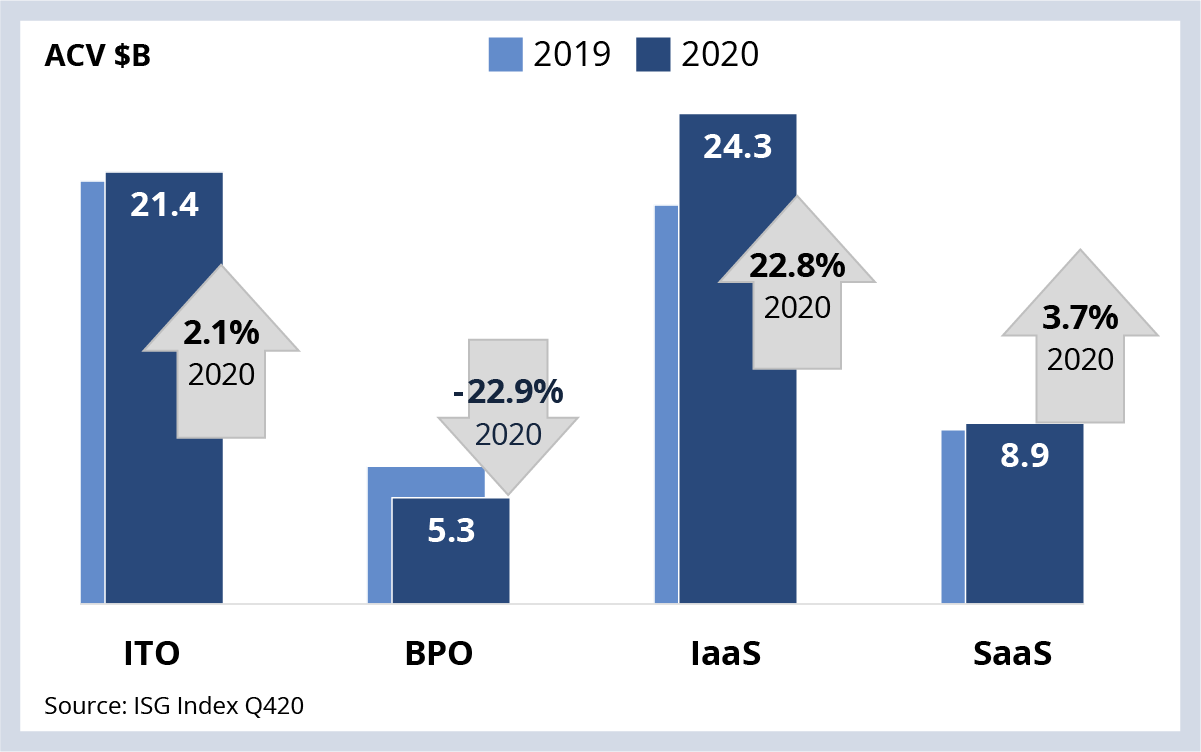

As we reported on the 73rd Global ISG Index call this week, the global combined market (managed services + as-a-service markets) closed out the year with its best quarter yet. Q4 annual contract value (ACV) rose 13% year over year. Managed services ACV of $7.2 billion was up 3% from the same period in 2019 due to Q4 mega deals between Daimler and Infosys, Siemens and Atos, Metro AG and Wipro, Postbank and TCS, and Prudential and TCS. For the full year, the global combined market finished up 6.6% over 2019.

The results for the managed services market exceeded our expectations given two factors: 1) cost pressure on industries heavily impacted by the pandemic and 2) the fact that hundreds of thousands of provider resources had to pivot to a virtual delivery model nearly overnight. And while the pivot to a virtual model was disruptive to both buyers and sellers, our view is that the global delivery model delivered in 2020. As-a-service growth was in line with our expectations, with strong demand for IaaS from the hyperscale providers as enterprises continue their transformation to a cloud-based delivery model.

DATA

Global Results by Function

2020 was the best year ever for ITO ACV. BPO was down significantly on weak results in facilities management. IaaS growth continues to accelerate. SaaS decision-making was delayed in EMEA and Asia Pacific.

M&A

Atos confirmed it has approached DXC Technology. The deal value is reported to be in the $10 billion range. Atos has been active with two cybersecurity acquisitions (Motiv ICT and In Fidem) in the last 30 days, but a merger with DXC would be its largest-ever transaction — triple the size of its Syntel acquisition in 2018 (see our original POV here). We have identified 21 publicly announced shared clients, 20 of which are based in Europe. Beyond the acquisition being an opportunity for Atos to create scale, it may also give Atos the chance to leverage its OneCloud investments in the U.S. where hyperscale cloud growth is accelerating.

PEOPLE

IBM NewCo announces CEO. Martin Schroeter, former IBM CFO, will lead IBM’s new managed infrastructure business. My colleague Mrinal Rai wrote this earlier this year when the spinoff was announced: "In a post-COVID reality, creating and delivering cloud solutions requires a different outlook than maintaining and managing them. IBM has taken a much-awaited bold step to revitalize its own growth, and its success will depend on its ability to service this new reality.”

POLICY

Wage minimums increasing for H-1B visa holders. The U.S. administration this week announced changes to the prevailing wage rates for worker visas, including the H-1B. The changes will be phased in starting July of this year. As we discussed earlier, technology vendors like Apple, Amazon, Google and Microsoft have been more significantly impacted by recent tightening of H-1B policy than the top H-1B petitioners, including Cognizant, Infosys, TCS and Wipro. We’re tracking this closely to see what changes the incoming administration may make.

CYBERSECURITY

SolarWinds breach continues to metastasize. The company announced this week that the attack started a month earlier than it first disclosed. Additionally, it appears that the attack has compromised SolarWinds' software development and build process. Expect to see significantly increased scrutiny on third-party managed security and DevSecOps services over the coming year. While we believe we’ll see very strong demand in this area in 2021, we also expect to see due diligence activities skyrocketing.

INDEX REWIND

As we discussed on the Index call earlier this week, five mega deals were awarded with an ACV greater than $100 million per year in Q4 2020. The value of those five awards totals $1.7 billion, which is the highest ACV mark since 1Q17. Given how important these mega deals were to the managed services market in 2020, here’s a look back at What Happened to the Billion-Dollar Deal.