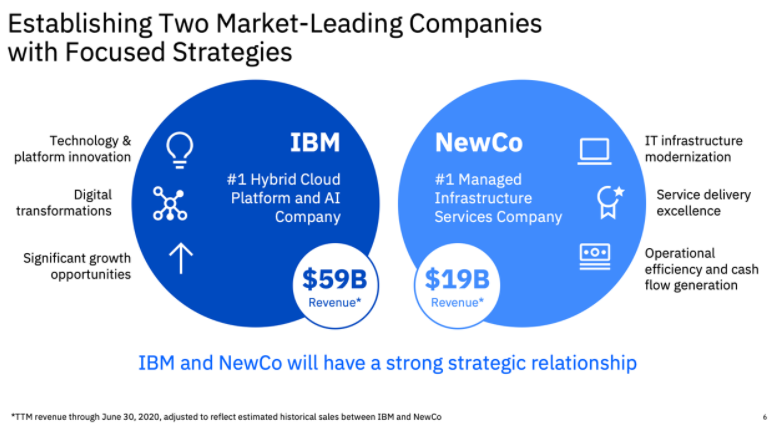

IBM announced yesterday its decision to spin off its underperforming managed infrastructure services division and split the firm into two separate companies (Figure-1). This announcement signals a definitive move by IBM to establish a more firm position in the high-margin hybrid cloud business. As enterprises are ramping up their cloud infrastructure with digital transformation, especially in the post-COVID world, there is significant potential for growth of open-source hybrid cloud solutions.

IBM’s announcement reflects a deepening commitment to laser focus on this growing market opportunity. IBM’s legacy managed infrastructure services business was not only impacting the focus on accelerating its cloud growth, but it also was resulting in a significant conflict of interest between its on-premises infrastructure and its RedHat-enabled business. For that reason, it is spinning off its legacy managed infrastructure services business, which was, until yesterday, part of its Global Technology Services (GTS) unit.

Figure 1: IBM announces split

Source: IBM

The company has been struggling with its managed infrastructure services division for quite some time now. IBM never reported revenue from this segment separately, though its infrastructure and cloud services revenue from the GTS segment was negative 6.5 percent in 2019 and remained negative over the last two quarters in of 2020. At the same time, its cloud and cognitive business, which includes a cloud platform spearheaded by its RedHat acquisition, has shown substantial growth, both in annual and quarterly results.

The RedHat acquisition enabled IBM to significantly enhanced its capabilities in the hybrid cloud market by positioning its cloud offerings as open-source and less proprietary than the competition. The mammoth $34 billion acquisition in 2018 is certainly paying off with strong growth and has ultimately led IBM to separate this business from other slow-growth segments. Along with the hybrid cloud business, key IBM growth accelerators such as Watson, Quantum computing, RedHat and IBM Cloud will stay with the new IBM, providing a solid portfolio of products.

While all this looks promising for the new IBM, it does not mean that things are bleak for “NewCo,” whose name is yet to be decided. In fact, unlike other spin-offs in which the newer firm is smaller and more vulnerable, in this case, NewCo is twice the size of its next biggest competitor. NewCo is not only positioned to leverage cognitive capabilities from IBM Watson, it also will be open to work with solutions from other vendors in the future. This provides strong potential for the company to sell AI-led automation and cloud migration services to help streamline costs for its IT infrastructure clients.

In the aftermath of this surprising announcement, ISG is raising some key concerns and questions that its clients may have to face:

Dealing with two vendors or one? IBM’s services and solutions business has often acted as two separate companies, frustrating common clients. These clients usually expect end-to-end service delivery and contracts that are tied together for pricing advantages. With this move, clients for whom IBM is managing both traditional and cloud services may be concerned about dealing with two vendors instead of one. There could be competition between the two organizations, with one taking ownership of the private cloud offering. Clients that have a contract stating IBM cannot reassign the contract to a third party will ask whether they should stick with IBM or move to NewCo.

Impact at local/regional level? The announcement has been a shock for the industry and for some IBM client executives working at the regional or local level. While IBM can ensure little disruption for clients, there may still be concerns about how the news trickles down to functions in respective regions or countries. For example, will current services be transferred from country-level IBM to new country-level NewCo?

What about mainframe management costs? The new IBM has made it clear that it will keep, among many other businesses, the mainframe business, as it is key to its hybrid strategy. ISG deals with many clients working with IBM mainframes, and they share a common concern about the relationship and cost structure between their software division and NewCo. As the cost of software forms the bigger chunk in overall mainframe operation management costs, these companies will need to know if the NewCo will include zOS software within its service stack.

In the coming days, IBM will undoubtedly address immediate client concerns about its announcement, and it will need to be careful about people movement and workforce transition related to such a move. It must ensure that the transition will have limited impact on client relationships, maintain service levels and align clients contracts and engagements in a transparent way with no additional management pricing. Finally, it will need to cascade the spin-off beyond business and people to processes and the company’s culture as a whole.

In a post-COVID reality, creating and delivering cloud solutions requires a different outlook than maintaining and managing them. IBM has taken a much-awaited bold step to revitalize its own growth, and its success will depend on its ability to service this new reality.