Hello. This is Stanton Jones and Steve Hall with what’s important in the IT and business services industry this week.

If someone forwarded you this briefing, consider subscribing here.

Europe, Middle East and Africa

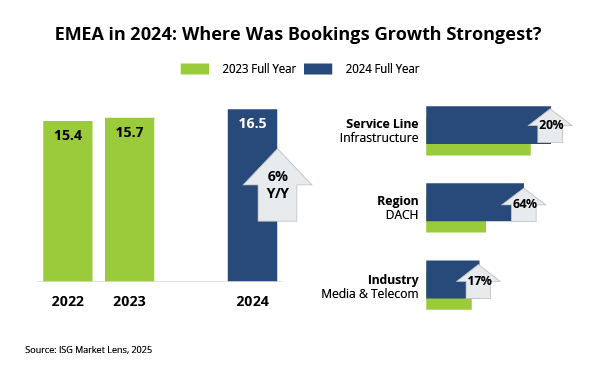

The EMEA region saw healthy growth in IT and business services bookings in 2024 driven by several large awards and strong demand for infrastructure outsourcing. Growth in 2025 is likely to be more subdued as discretionary spending remains muted in the region.

Data Watch

Background

The EMEA region saw healthy annual contract value (ACV) growth in 2024. As you can see from this week’s Data Watch, most of this growth came from three areas: 1) the infrastructure service line, 2) the DACH region, 3) and the media and telecom vertical.

European enterprises were laser-focused on cost optimization last year. This resulted in strong growth in “multi-tower deals” – deals that combine multiple infrastructure towers or that combine infrastructure with applications.

Last year, we talked a lot about this bundling trend and how enterprises are increasingly recognizing the need to capture further savings in their outsourcing agreements through transformation. Much of this transformation is happening, especially in Europe, as multi-tower deals.

And some of these deals were mega deals with an annual contract value of $100 million or more. There were 13 of them to be exact in 2024, with a number of them in the DACH region, which drove the very strong results for that region.

The Details

- The EMEA region generated $16.5 billion ACV in 2024, up 6%.

- Infrastructure ACV of $5.5 billion was up 20%.

- The DACH region generated $4.3 billion ACV, which was up 64%.

- Media and telecom ACV of $2.3 billion was up 17%.

What’s Next

While contracting activity was healthy in EMEA in 2024, the outlook for the region is more subdued for 2025. The combination of geopolitical uncertainty, elevated energy prices and persistent inflation means that discretionary spending is likely to remain muted in the region. This could have an outsized impact on applications-related work, which makes up almost 60% of the region’s ACV.

That said, we do see some bright spots. On the ground with clients, we’re continuing to see strong demand for SAP transformations, lots of activity with global capability centers and robust contracting activity in the public sector and the aerospace and defense industry.

We expect to see a healthy pipeline of large-deal activity continue in 2025 as European enterprises use the IT services sector to optimize their costs through technology transformation and modernization.