2023 has been an eventful year in which enterprise demand for technology outsourcing has remained strong. Meanwhile, discretionary spending pressure has dampened cloud growth and put pressure on service provider growth. Activity and interest in global capability centers are at their highest levels ever, and generative AI is starting to drive revenue – and new levels of productivity – for service providers.

What’s coming in 2024? Here are ten trends that will shape the IT and business services industry next year.

If someone forwarded you this briefing, consider subscribing here.

10 TRENDS THAT WILL SHAPE THE INDUSTRY IN 2024

1. Managed services bookings will remain strong. Even with slowing inflation and the possibility of lower interest rates, enterprises across the globe will focus on cost reduction in the face of uncertain demand. Industries like energy and healthcare are likely to remain steady, while telecom and media will continue to face challenges. This will support outsourcing bookings in line with what we’ve seen in 2023.

2. Funding for discretionary projects will continue to be suppressed. Over 70% of enterprises indicate that cost optimization is a key source of funding for strategic initiatives. Heading into 2024, IT budgets as a percentage of revenue remain relatively flat, and hurdle rates inside of companies will remain elevated. Enterprises will continue to rely on cost optimization to fund transformation, which will in turn put pressure on service providers that rely primarily on project-based work.

3. Large and megadeal activity will continue to be strong. The industry will close out the year with the most mega award activity in five years. This trend is likely to continue into 2024 as enterprises use the services sector to optimize costs through transformation. At the same time, some leading providers will continue to mature their capabilities around shaping large deals, especially where they have a strong incumbent position.

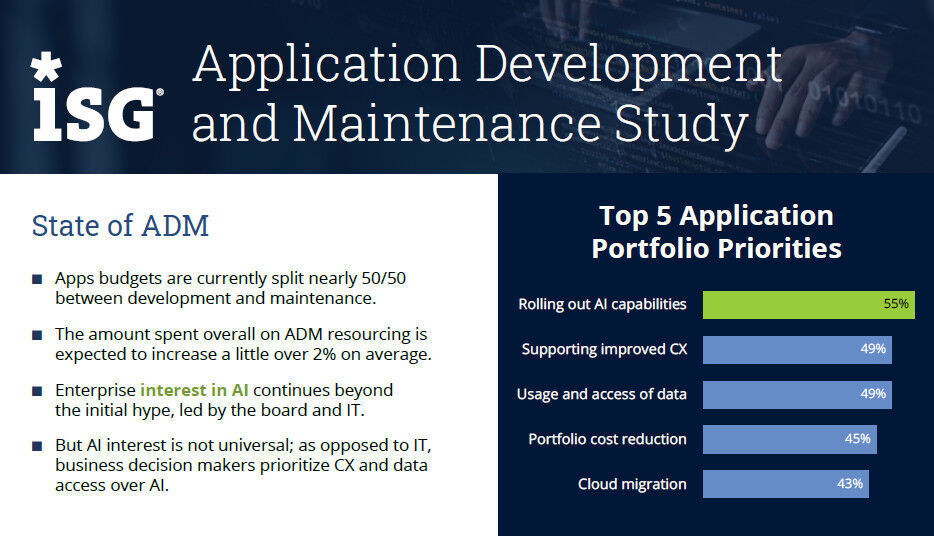

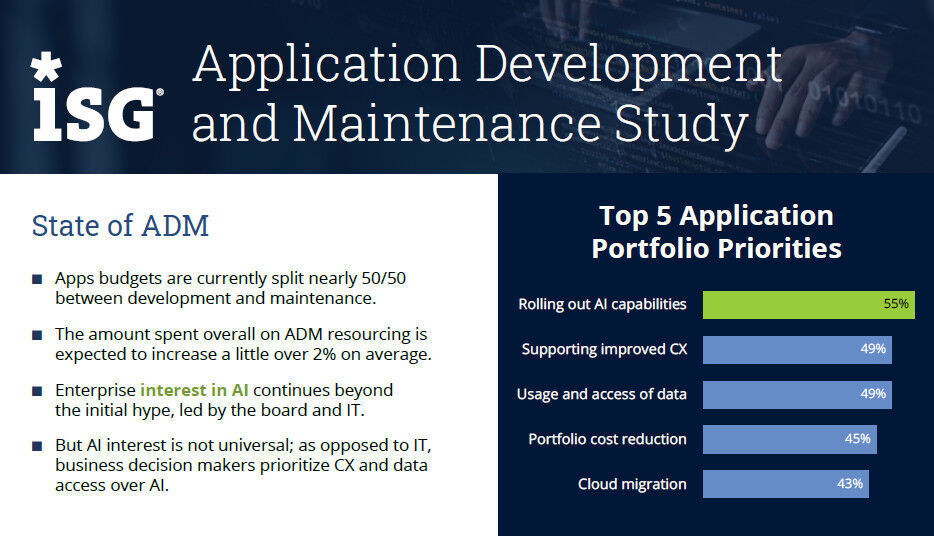

4. Applications will continue to be the primary growth driver for managed services. Applications development and maintenance (ADM) is now 65% of the IT services contract value in the market, up from 45% just four years ago. On the maintenance side, look for a wave of portfolio rationalizations as enterprises look to further optimize their run costs. And on the development side, look for AI to play a major role here as it starts to increase developer productivity and automate increasingly complex workflows.

Download the 2024 ISG Application Development and Maintenance Study

5. Cloud bookings will start to recover. Infrastructure-as-a-service bookings are starting to stabilize, and software-as-a-service bookings have started growing again. AI will drive new demand in IaaS as enterprises look to keep expensive GPUs fully utilized, and providers will embed new generative AI features into their tools, driving more business demand for software-as-a-service.

6. The delivery side of the industry will continue to look for its new normal. Hiring will continue to be muted in 2024 given the continued pressure on discretionary spending. Providers will continue to be cautious about campus-based hiring and will rely on the subcontractor channel and lateral hires to handle short-term spikes in demand. We’ll also see massive-scale AI training programs in full swing in 2024 as providers upskill their staffs to increase productivity.

7. Global capability center activity will continue to be strong. Enterprises will remain active on the GCC front given the desire to retain technology talent while at the same time reducing costs. GCCs that were established three to four years ago will continue to add staff, while GCCs that were established prior to 2015 may start to slow – or even exit – their GCC footprints, which could in turn, lead to more large and mega-deals for providers.

8. AI spending will increase – at the expense of other areas in the IT budget. As we discussed a couple weeks ago, Amazon, Google and Microsoft are deploying generative AI as a standalone product and integrating it into their existing products. But so is just about every other software vendor. This will drive up per-seat pricing, which will force enterprises to reassess other projects given the pressure on IT budgets in 2024.

9. Generative AI will start to have a material impact on provider productivity. Based on what we’re seeing happen in the field – and the data we’ve gathered from across 140 use cases – we believe we’ll start to see double-digit productivity improvements from providers in 2024. Enterprises won’t see labor rates decline, but they will see price reductions, as providers get more productive as a result of generative AI.

10. The AI explosion will accelerate cybersecurity investments. Just over half of security leaders rate emerging AI threats as a top concern over the next two years. For example, tools like ChatGPT and other open-source, general-purpose language models will make it easier to generate malicious content. Bad actors will benefit from rapid prototyping of new technologies that can impersonate people, especially in areas like phishing and social engineering. Enterprises plan to respond in 2024 with better employee training and more threat prevention technology.

We’ve already shared these trends with several ISG clients over the past few days, and we’d love your feedback as well. You can always reply to this email with any questions or feedback you have.

And don’t forget: we’ll be discussing these – and 2023 results – on the Q4 and full-year Index call on January 18, so make sure to reserve your spot.

2. Funding for discretionary projects will continue to be suppressed. Over 70% of enterprises indicate that cost optimization is a key source of funding for strategic initiatives. Heading into 2024, IT budgets as a percentage of revenue remain relatively flat, and hurdle rates inside of companies will remain elevated. Enterprises will continue to rely on cost optimization to fund transformation, which will in turn put pressure on service providers that rely primarily on project-based work.

3. Large and megadeal activity will continue to be strong. The industry will close out the year with the most mega award activity in five years. This trend is likely to continue into 2024 as enterprises use the services sector to optimize costs through transformation. At the same time, some leading providers will continue to mature their capabilities around shaping large deals, especially where they have a strong incumbent position.

4. Applications will continue to be the primary growth driver for managed services. Applications development and maintenance (ADM) is now 65% of the IT services contract value in the market, up from 45% just four years ago. On the maintenance side, look for a wave of portfolio rationalizations as enterprises look to further optimize their run costs. And on the development side, look for AI to play a major role here as it starts to increase developer productivity and automate increasingly complex workflows.

Download the 2024 ISG Application Development and Maintenance Study

5. Cloud bookings will start to recover. Infrastructure-as-a-service bookings are starting to stabilize, and software-as-a-service bookings have started growing again. AI will drive new demand in IaaS as enterprises look to keep expensive GPUs fully utilized, and providers will embed new generative AI features into their tools, driving more business demand for software-as-a-service.

6. The delivery side of the industry will continue to look for its new normal. Hiring will continue to be muted in 2024 given the continued pressure on discretionary spending. Providers will continue to be cautious about campus-based hiring and will rely on the subcontractor channel and lateral hires to handle short-term spikes in demand. We’ll also see massive-scale AI training programs in full swing in 2024 as providers upskill their staffs to increase productivity.

7. Global capability center activity will continue to be strong. Enterprises will remain active on the GCC front given the desire to retain technology talent while at the same time reducing costs. GCCs that were established three to four years ago will continue to add staff, while GCCs that were established prior to 2015 may start to slow – or even exit – their GCC footprints, which could in turn, lead to more large and mega-deals for providers.

8. AI spending will increase – at the expense of other areas in the IT budget. As we discussed a couple weeks ago, Amazon, Google and Microsoft are deploying generative AI as a standalone product and integrating it into their existing products. But so is just about every other software vendor. This will drive up per-seat pricing, which will force enterprises to reassess other projects given the pressure on IT budgets in 2024.

9. Generative AI will start to have a material impact on provider productivity. Based on what we’re seeing happen in the field – and the data we’ve gathered from across 140 use cases – we believe we’ll start to see double-digit productivity improvements from providers in 2024. Enterprises won’t see labor rates decline, but they will see price reductions, as providers get more productive as a result of generative AI.

10. The AI explosion will accelerate cybersecurity investments. Just over half of security leaders rate emerging AI threats as a top concern over the next two years. For example, tools like ChatGPT and other open-source, general-purpose language models will make it easier to generate malicious content. Bad actors will benefit from rapid prototyping of new technologies that can impersonate people, especially in areas like phishing and social engineering. Enterprises plan to respond in 2024 with better employee training and more threat prevention technology.

We’ve already shared these trends with several ISG clients over the past few days, and we’d love your feedback as well. You can always reply to this email with any questions or feedback you have.

And don’t forget: we’ll be discussing these – and 2023 results – on the Q4 and full-year Index call on January 18, so make sure to reserve your spot.