The 2018 Momentum® Market Trends & Insights Vertical Report provides an industry-by-industry look into outsourcing spending patterns, emerging preferences and other trends across 26 vertical markets. It offers perspective into the state of outsourcing in each vertical through interviews with strategists involved in current outsourcing engagements in that industry, worldwide spending and market share data that shows current levels and up to 10 years of history, and it notes how current events are shaping each industry.

Executive Summary

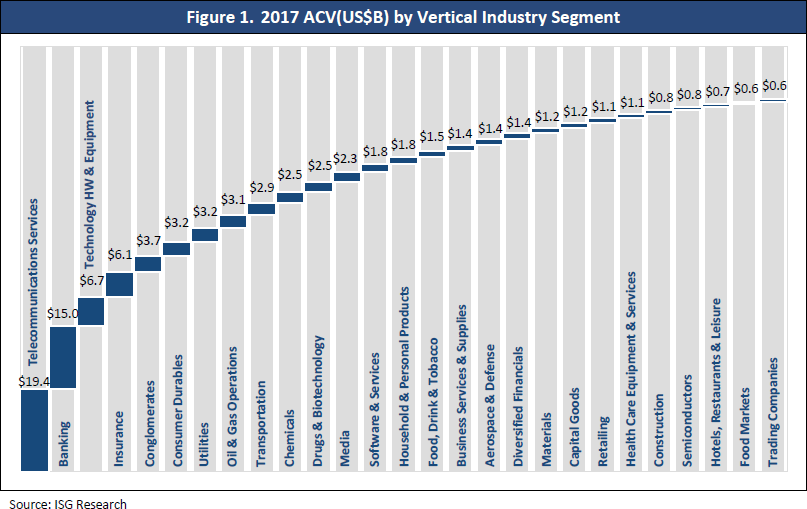

In a year when enterprises were finding new ways to benefit from new technologies and outsourced services that are becoming available in their industries, the four largest vertical industry markets — Telecommunications Services, Banking, Technology Hardware & Equipment, and Insurance — produced $47.2 billion in ACV from clients in the Forbes® Global 2000 in 2017 (see Figure 1). That sum represents 54 percent of the total ACV in all G2000 companies. Conversely, the 14 verticals that represent the bottom half of the spend ranking combined for $15.4 billion in ACV, which is 18 percent of the market total. Half of the 27 verticals had $1.5 billion or more in ACV in 2017, and half had less.

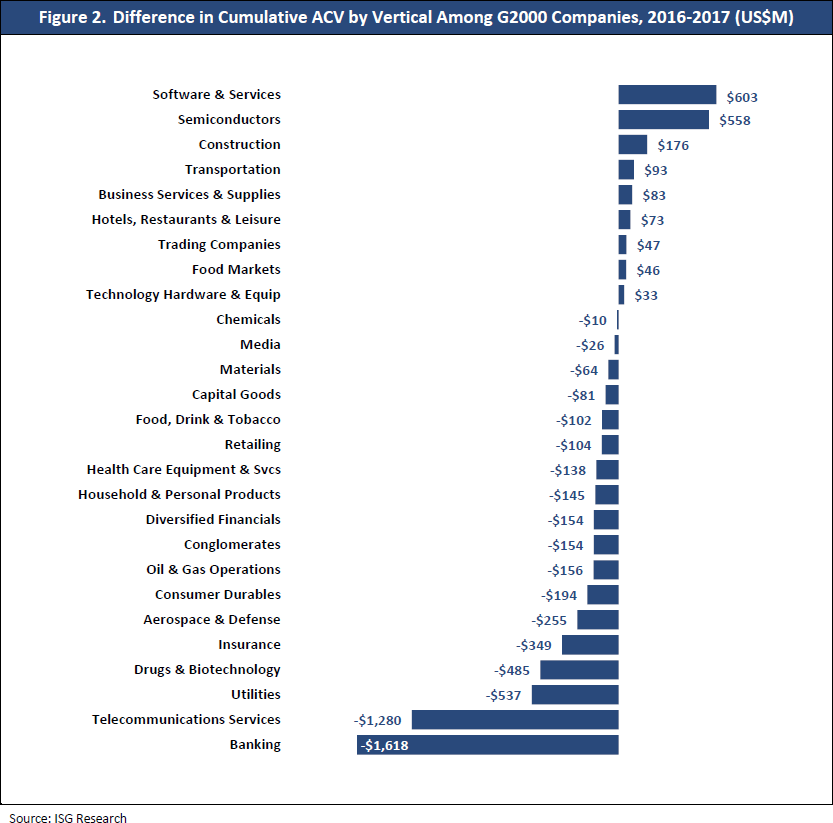

Nine of the 27 vertical industries achieved a year-over-year ACV gain in 2017, when total annual ACV in the market declined by 5 percent. Software & Services, Semiconductors and Construction were the only verticals where annual ACV increased by more than $100 million. Although those three verticals had the largest net gains in ACV, they are not among the largest overall verticals. The top two markets by ACV, Telecommunications Services and Banking, had the two largest net ACV declines in 2017, approximately $1.3 billion and $1.6 billion, respectively. Nineteen of the 27 verticals were within $200 million of their prior-year ACV level in 2017.

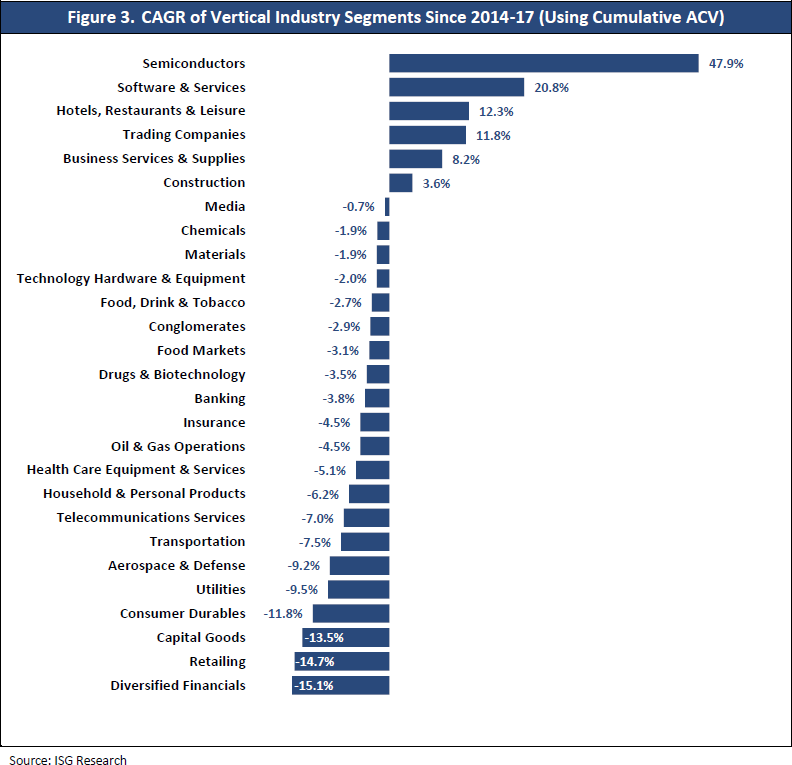

Semiconductors added the second most ACV in 2017 and had the highest compound annual growth rate (CAGR) among all verticals over the last three years. Conversely, Software & Services added the most ACV in 2017 and it has the second highest three-year CAGR (Figure 3). Ten verticals had CAGR rates below the -4.8 percent market average. Verticals with relatively low total ACV tend to have higher percentage changes. Only one of the six verticals that posted positive CAGR rates over the past three years ranks in the top half of all verticals by total ACV, and four are in the bottom five. Of the 10 verticals with the largest CAGR declines, four rank in the top 10 for ACV — Telecommunications Services, Utilities, Consumer Durables and Transportation — and five ranked 17th or lower.

Momentum subscribers click here to read the full report